Home | How It Works

In minting the $1 trillion platinum coin, the

Treasury Secretary would be exercising authority which

Congress has granted routinely for more than 220 years.

The Secretary’s authority is derived from

an Act of Congress...under power

expressly granted to Congress in the Constitution...

[T]he accounting treatment of the coin is

identical to the treatment of all other coins...

There are no negative macroeconomic effects.

This works just like additional tax revenue or

borrowing under a higher debt limit...

The law provides Treasury

all necessary authority to pursue this course.

I know this because I wrote the law and

produced the nation’s first platinum coin.

I’ve been through the entire process.

- Philip Diehl, 35th Director, U.S. Mint (1994-2000)

Email Correspondence, Jan. 8, 2013

Although #MintTheCoin raises some nuanced legal questions, the operational mechanics are quite straightforward:

Step 1: The Legal Directive

The Treasury Secretary directs the Mint to issue as many proof platinum coins with high face value (i.e. $1 trillion, or lower to begin with) as necessary to meet the U.S. government's ongoing spending commitments until regular budget operations resume.

Step 2: Physical Production

The Mint makes minor adjustments to its existing plaster mold of its $100 Platinum Eagle bullion coin (i.e. adjusting the denomination), transfers the new design to a plastic resin mold, and then uses existing platinum "blanks" to mint new high-value platinum coins an as-needed basis.

According to former Mint Director Philip N. Diehl, through this process the U.S. Mint can begin producing new high-value platinun coins "within hours of the Treasury Secretary's decision to [instruct it to] do so."

Step 3: Issuance and Deposit

The Mint deposits the newly minted coin(s) at the Federal Reserve, or alternatively, sells them directly to financial investors and the public, who can then deposit them at their own commercial banks, which in turn can deposit them at the Federal Reserve.

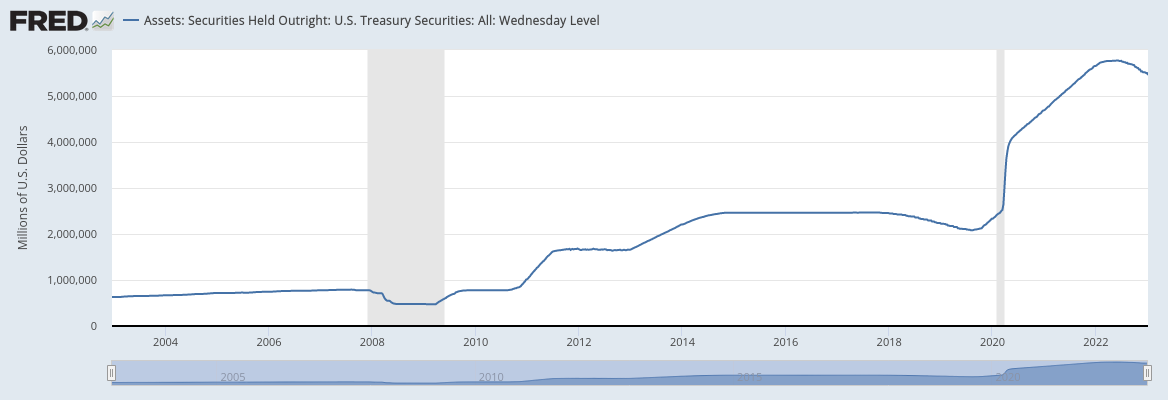

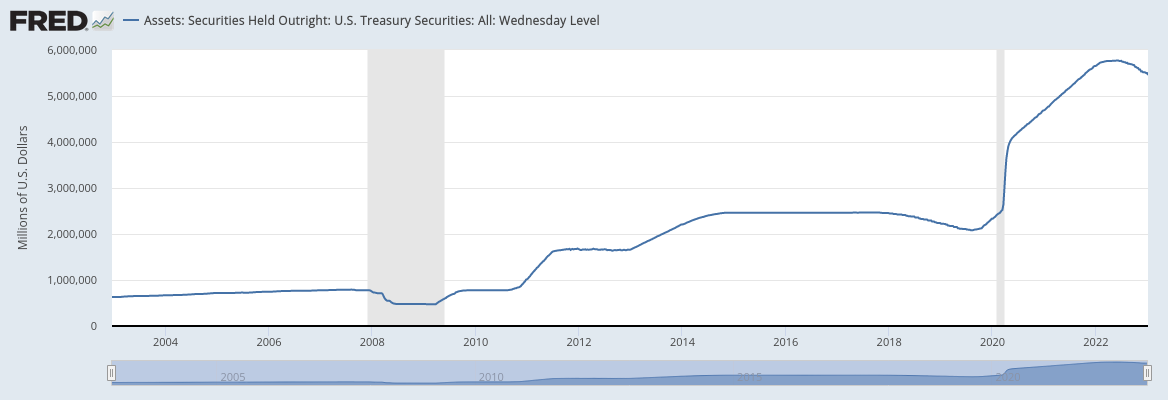

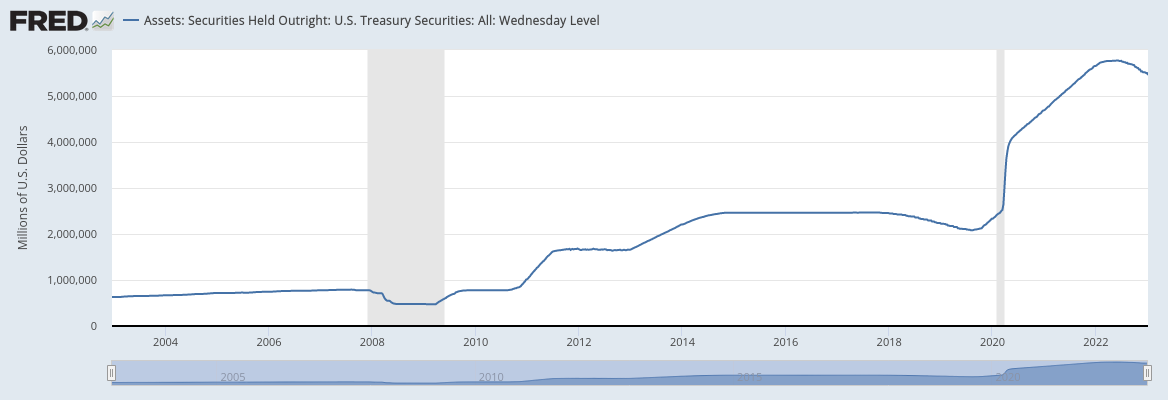

In both cases, the Mint is credited for the full nominal face value of the coins via its dedicated reserve account at the Fed, and the coins end up being held as assets on the Fed's balance sheet, along with the trillions of dollars of Treasury securities it already holds.

Source: Federal Reserve Bank of St. Louis

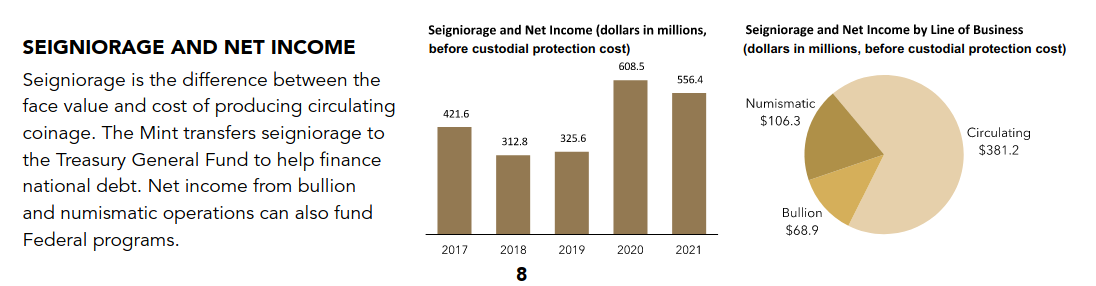

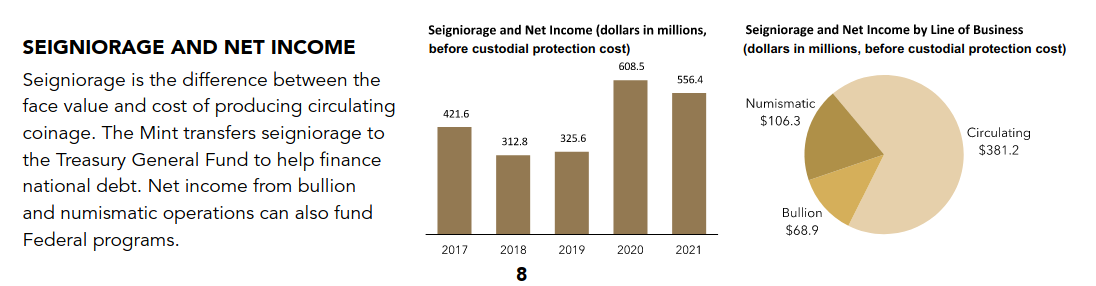

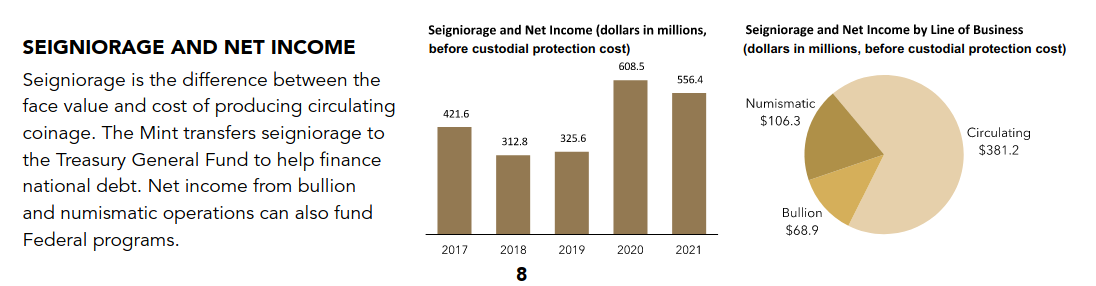

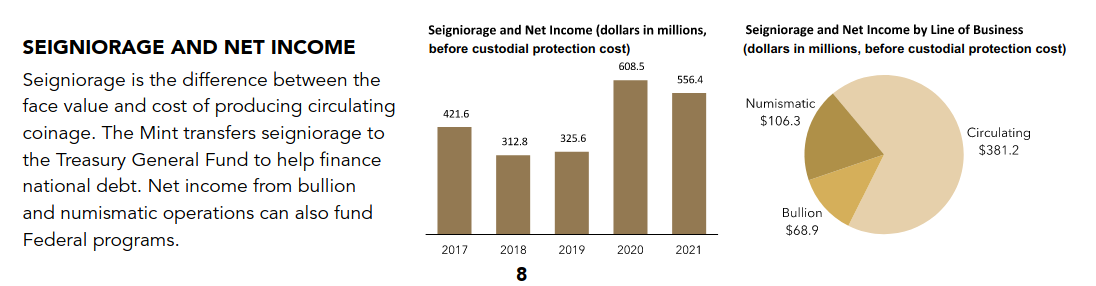

Step 4: Transferring Seigniorage Revenue to the Treasury's General Fund

The Treasury Secretary directs the Mint to transfer the newly acquired funds to the Treasury's general operating account at the Federal Reserve, at which point they become available for regular federal budget operations.

Source: U.S. Mint 2021 Annual Report

The Mint makes minor adjustments to its existing plaster mold of its $100 Platinum Eagle bullion coin (i.e. adjusting the denomination), transfers the new design to a plastic resin mold, and then uses existing platinum "blanks" to mint new high-value platinum coins an as-needed basis.

According to former Mint Director Philip N. Diehl, through this process the U.S. Mint can begin producing new high-value platinun coins "within hours of the Treasury Secretary's decision to [instruct it to] do so."

According to former Mint Director Philip N. Diehl, through this process the U.S. Mint can begin producing new high-value platinun coins "within hours of the Treasury Secretary's decision to [instruct it to] do so."

Step 3: Issuance and Deposit

The Mint deposits the newly minted coin(s) at the Federal Reserve, or alternatively, sells them directly to financial investors and the public, who can then deposit them at their own commercial banks, which in turn can deposit them at the Federal Reserve.

In both cases, the Mint is credited for the full nominal face value of the coins via its dedicated reserve account at the Fed, and the coins end up being held as assets on the Fed's balance sheet, along with the trillions of dollars of Treasury securities it already holds.

Source: Federal Reserve Bank of St. Louis

Step 4: Transferring Seigniorage Revenue to the Treasury's General Fund

The Treasury Secretary directs the Mint to transfer the newly acquired funds to the Treasury's general operating account at the Federal Reserve, at which point they become available for regular federal budget operations.

Source: U.S. Mint 2021 Annual Report

In both cases, the Mint is credited for the full nominal face value of the coins via its dedicated reserve account at the Fed, and the coins end up being held as assets on the Fed's balance sheet, along with the trillions of dollars of Treasury securities it already holds.

The Treasury Secretary directs the Mint to transfer the newly acquired funds to the Treasury's general operating account at the Federal Reserve, at which point they become available for regular federal budget operations.

Source: U.S. Mint 2021 Annual Report